Investment banking is the beating heart of the global economy, where high-stakes decisions, complex financial transactions, and strategic investments drive the future of industries. The sector is known for its fast pace, intense pressure, and the need for exceptional talent. As technology rapidly evolves, professionals in this field must adapt to new tools and strategies, particularly with the rise of AI and digital transformation. A PMP certification can be your golden ticket to thriving in this dynamic environment, especially if you’re aiming for a career in firms like Citadel, Bridgewater, Goldman Sachs, JP Morgan, Centerpoint, Blackstone, KKR, or Blackrock.

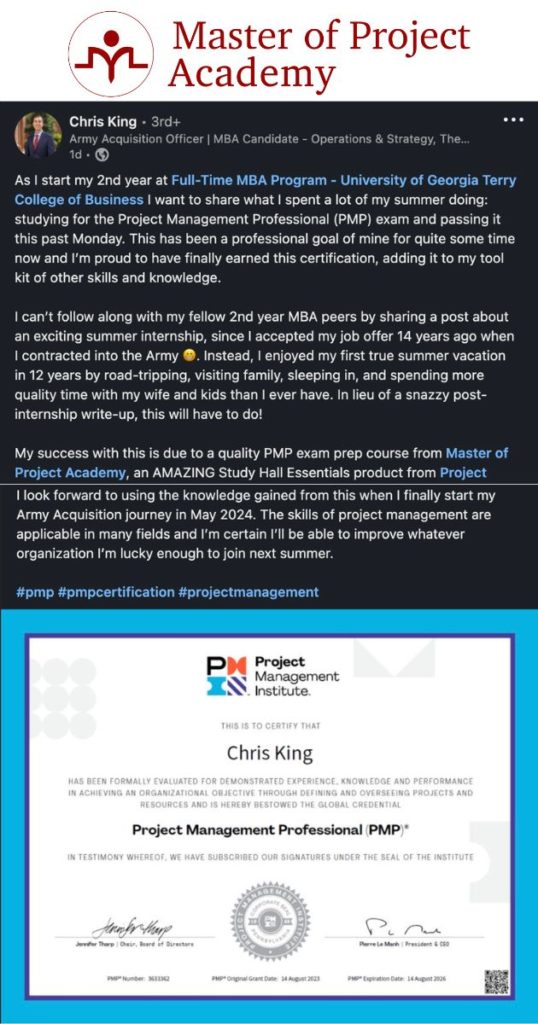

Enroll in Master of Project Academy’s PMP training courses and start your PMP journey today:

Why PMP Certification Matters in Investment Banking

Project Management Professional (PMP) certification is recognized globally as a gold standard for project management. In the investment banking sector, where the stakes are high and the projects are complex, having a PMP certification can set you apart. Here’s why:

1. Structured Approach to Complex Projects: Investment banking involves managing large-scale projects such as mergers and acquisitions (M&A), initial public offerings (IPOs), and complex financial modeling. A PMP certification equips you with the skills to handle these projects with precision, ensuring that all phases—from initiation to closure—are executed flawlessly.

2. Risk Management Expertise: Risk management is crucial in investment banking. PMP certification provides you with the tools to identify, assess, and mitigate risks effectively. This is particularly important when dealing with volatile markets or high-value transactions, where a single misstep can have significant financial implications.

3. Adaptability in a Technologically Evolving Sector: The financial services sector is undergoing a digital transformation, with AI and machine learning playing increasingly central roles. A PMP certification not only gives you foundational project management skills but also prepares you to adapt and manage projects in this rapidly changing environment.

4. Leadership and Communication Skills: Leading cross-functional teams, coordinating with stakeholders, and ensuring effective communication are key components of investment banking projects. PMP training emphasizes these soft skills, making you a more effective leader and collaborator in high-pressure situations.

5. Global Recognition and Opportunities: A PMP certification is recognized worldwide, making it a valuable asset if you’re aiming to work in major financial hubs like New York. The keyword “PMP New York” is especially relevant here, as the city is a global leader in finance, with countless opportunities for certified professionals.

The Value of MBA Skills Over the Degree Itself

While an MBA is often seen as a critical stepping stone in investment banking, top firms like Citadel, Bridgewater, and Goldman Sachs increasingly value the application of MBA concepts and strategies over the mere possession of the degree. In today’s competitive landscape, it’s not just about having the letters “MBA” on your resume—it’s about how effectively you can apply the knowledge gained during your MBA studies to real-world scenarios.

- Unlock Your Career Success with MBA-Style Case Studies

1. Strategic Thinking and Problem Solving: Investment banks seek professionals who can think strategically and solve complex problems on the fly. The ability to apply MBA concepts like financial modeling, strategic management, and corporate finance in high-pressure situations is what sets top candidates apart. Firms are looking for those who can use these concepts to drive innovation and efficiency, not just those who can recite theory.

- Check out our Financial Modeling and Forecasting course

2. Data-Driven Decision Making: With the rise of AI and big data, the ability to make informed, data-driven decisions is more critical than ever. MBA graduates who can translate data analysis into actionable insights, particularly in areas like risk management and investment strategies, are highly valued. It’s about taking the theoretical knowledge from the classroom and applying it to the complex, data-rich environments that define modern investment banking.

- Master Decision-Making using the OODA Loop

3. Leadership and Execution: Beyond theory, investment banks need leaders who can execute strategies effectively. This includes managing teams, driving projects to completion, and ensuring that initiatives align with broader business goals. Firms like Blackstone and KKR are looking for professionals who can take the leadership principles learned in an MBA program and apply them in ways that produce tangible results.

4. Innovation and Adaptability: The financial landscape is evolving rapidly, with AI and digital transformation at the forefront. Banks value professionals who not only understand these changes but can also innovate and adapt MBA strategies to leverage new technologies. It’s not enough to know what’s in the textbooks—firms want employees who can think outside the box and drive change within the organization.

- Check out our Introduction to Analytics and AI Online Training Course

By focusing on these exceptional skills and their practical application, you’ll stand out to top investment banks, proving that you’re not just an MBA graduate, but a dynamic professional ready to make an impact.

Essential Concepts, Strategies, Processes, and Techniques from Harvard Business School’s MBA Program to Master for Success in Investment Banking

Harvard Business School (HBS) is renowned for its rigorous MBA program, which equips students with the skills, knowledge, and strategic thinking necessary to excel in the business world. For professionals aiming to stand out in investment banking, mastering these essential concepts, strategies, processes, and techniques taught at HBS can be a game-changer. Below is a detailed list of key areas to focus on:

1. Corporate Finance

- Valuation Techniques: Mastering valuation models such as Discounted Cash Flow (DCF), Comparable Company Analysis, and Precedent Transactions is crucial. These techniques are foundational in determining the value of companies, assets, and investment opportunities.

- Capital Structure Optimization: Understanding how to optimize a company’s capital structure to maximize value while minimizing cost is key. This includes balancing debt and equity financing and knowing when and how to issue securities.

- Mergers & Acquisitions (M&A): Knowledge of the entire M&A process, from identifying targets to executing deals and post-merger integration, is essential. This includes understanding synergies, due diligence, negotiation tactics, and regulatory considerations.

2. Strategic Management

- Porter’s Five Forces Analysis: This framework is essential for analyzing the competitive forces within an industry and developing strategies to increase a company’s competitive advantage.

- SWOT Analysis: A critical tool for assessing a company’s internal strengths and weaknesses, as well as external opportunities and threats. Mastering this analysis helps in strategic decision-making.

- Business Model Innovation: Understanding how to innovate and adapt business models to changing market conditions is crucial, especially in an industry as dynamic as investment banking.

- Corporate Strategy Formulation: This involves setting long-term objectives and determining the actions needed to achieve these goals. It includes decisions about diversification, vertical integration, and international expansion.

Check out Master of Project Academy Sandbox Membership which covers these areas of Strategic Management.

3. Financial Reporting and Control

- Advanced Financial Accounting: Mastery of financial accounting principles is crucial for accurately analyzing and interpreting financial statements. This includes understanding revenue recognition, expense matching, and the intricacies of financial reporting standards.

- Performance Measurement Systems: Knowledge of how to design and implement systems that measure and manage business performance. This includes using Balanced Scorecards and Key Performance Indicators (KPIs) to align business activities with strategic goals.

- Internal Controls and Corporate Governance: Understanding the importance of internal controls and the role of corporate governance in ensuring the accuracy and integrity of financial information.

Check out Master of Project Academy’s Financial Forecasting and Modeling Training Course.

4. Operations Management

- Process Analysis and Improvement: The ability to analyze business processes and identify inefficiencies is vital. Techniques like Lean Management and Six Sigma are commonly taught to improve operational efficiency. Check out our Lean Six Sigma Green Belt Certification training.

- Supply Chain Management: Understanding the complexities of global supply chains, including logistics, inventory management, and supplier relationships, is critical, especially in sectors heavily reliant on global networks.

- Risk Management in Operations: Knowledge of how to identify and mitigate operational risks, including those related to supply chain disruptions, production delays, and quality control issues.

5. Marketing Strategy

- Market Segmentation and Targeting: Mastery of techniques to segment markets and identify target audiences is essential. This includes understanding consumer behavior and applying it to develop effective marketing strategies.

- Brand Management: The ability to build and manage brand equity, including positioning, differentiation, and creating a brand that resonates with customers.

- Digital Marketing and Analytics: Understanding the tools and techniques for online marketing, including SEO, social media marketing, and the use of analytics to measure campaign effectiveness.

6. Entrepreneurship and Innovation

- Venture Capital and Private Equity: Knowledge of how to raise capital for startups, including understanding the venture capital process, valuation of startups, and exit strategies.

- Innovation Management: Techniques for fostering innovation within organizations, including managing R&D, encouraging creative thinking, and driving new product development.

- Business Plan Development: Skills in crafting comprehensive business plans that effectively communicate the business model, market opportunity, financial projections, and strategic vision.

7. Leadership and Organizational Behavior

- Change Management: Mastery of the processes and techniques needed to lead organizational change. This includes understanding the psychological aspects of change, communication strategies, and overcoming resistance.

- Team Dynamics and Leadership: Insights into how to build, manage, and lead high-performing teams. This includes understanding team roles, conflict resolution, and leadership styles.

- Corporate Culture and Ethics: Knowledge of how to create and sustain a strong corporate culture that aligns with business goals and ethical standards. This includes understanding the impact of corporate culture on performance and employee engagement.

Have your company secure PM Leadership Training from Master of Project Academy.

8. Global Business and Economics

- International Trade and Investment: Understanding the complexities of global trade, including tariffs, trade agreements, and foreign direct investment. This knowledge is crucial for investment bankers working with multinational corporations.

- Macroeconomic Analysis: The ability to analyze and interpret macroeconomic indicators, such as GDP, inflation, interest rates, and exchange rates, and their impact on global financial markets.

- Emerging Markets Strategy: Knowledge of the unique challenges and opportunities in emerging markets, including political risk, currency risk, and strategies for market entry and growth.

9. Negotiation and Deal-Making

- Negotiation Techniques: Mastery of negotiation strategies, including understanding the interests of all parties, finding mutually beneficial solutions, and closing deals effectively.

- Contract Design and Legal Considerations: Understanding the legal aspects of contracts and deal-making, including terms and conditions, enforcement, and compliance with regulatory requirements.

- Conflict Resolution: Techniques for resolving conflicts during negotiations, whether they arise from cultural differences, misaligned expectations, or power imbalances.

10. Ethics and Corporate Responsibility

- Ethical Decision-Making Frameworks: Mastery of frameworks for making ethical decisions in complex business situations, ensuring that business practices align with moral and ethical standards.

- Corporate Social Responsibility (CSR): Understanding the importance of CSR in today’s business environment, including how to integrate social and environmental concerns into business strategy.

- Sustainability Practices: Knowledge of how to implement sustainable business practices that not only reduce environmental impact but also enhance long-term profitability.

Bottom Line

Mastering these essential concepts, strategies, processes, and techniques taught at Harvard Business School’s MBA program will not only set you apart in the competitive world of investment banking but will also equip you with the tools needed to excel in any business environment. Whether you’re managing complex financial transactions, leading global teams, or driving innovation, these skills will ensure that you are well-prepared to navigate the challenges and opportunities that lie ahead in your career.

Are you looking for other career paths? Check out our PMP career articles:

- The 7 Supply Chain Careers for PMP-Certified Project Managers

- Have You Considered a Broker Career?

- Why PMP Certification Holders Should Explore Retail and Restaurant Management Roles?

- 16 Fulfilling Career Paths for Junior Project Managers with PMP Certification

- The Infrastructure Boom: Lucrative Opportunities across the World for Project Managers

- Why Christian Louboutin Is the System Project Manager You Didn’t Know You Needed?

- Why a PMP Certification is Essential for Those Dreaming of a Career in Luxury Travel Planning?

How AI and Digital Transformation Are Shaping the Future of Investment Banking

Investment banking is no stranger to innovation, and the advent of AI and digital transformation is ushering in a new era for the sector. Here are some key trends:

1. AI-Driven Analytics and Decision-Making: AI is revolutionizing how investment banks analyze data and make decisions. Algorithms can now process vast amounts of data at lightning speed, providing insights that were previously unattainable. For example, firms like Goldman Sachs and JP Morgan are leveraging AI to enhance their trading strategies and optimize investment portfolios. Check out our Data Analytics courses.

2. Automation of Routine Tasks: Digital transformation is automating many of the routine tasks that were once handled by junior analysts. This frees up time for more strategic work, allowing professionals to focus on high-value activities. Understanding and managing these automation projects is where a PMP certification becomes invaluable.

3. Blockchain and Smart Contracts: Blockchain technology and smart contracts are set to revolutionize how transactions are executed in investment banking. These technologies promise greater transparency, security, and efficiency. Professionals with PMP certification will be well-equipped to manage the implementation of these complex systems.

4. Digital Customer Experience: As the financial services sector becomes more customer-centric, digital transformation is enhancing the client experience. AI-driven chatbots, personalized financial advice, and seamless digital interfaces are becoming the norm. Managing these customer-focused digital projects requires the structured approach that PMP certification provides.

Financial Roles That Will See Growth Thanks to AI and Digital Transformation

As AI and digital transformation reshape the financial landscape, certain roles within investment banking are poised for significant growth. Here are a few:

- AI and Data Science Specialists: These professionals will be at the forefront of analyzing data and developing AI-driven strategies. Their insights will drive investment decisions and optimize trading operations.

- Digital Transformation Managers: With the ongoing shift towards digital platforms, firms need experts who can manage the transformation process. This role will involve overseeing the integration of new technologies, ensuring that they align with business goals.

- Blockchain Project Managers: As blockchain technology becomes more prevalent, the need for project managers who can oversee the implementation of blockchain systems will grow. These professionals will be responsible for ensuring that these complex projects are completed on time and within budget.

- Cybersecurity Analysts: With the increasing reliance on digital platforms, cybersecurity has become a top priority. Analysts who can protect sensitive financial data and ensure the security of digital transactions will be in high demand.

- Client Relationship Managers with Digital Expertise: As the client experience becomes more digital, there will be a growing need for relationship managers who can bridge the gap between technology and customer service. These professionals will need to understand both the financial products and the digital tools that enhance the client experience.

Steps to Take to Work for Top Investment Banks

If you’re aiming to work for top investment banks like Citadel, Bridgewater, Goldman Sachs, JP Morgan, Centerpoint, Blackstone, KKR, or Blackrock, here are some steps you can take:

1. Obtain PMP Certification: Start by getting your PMP certification. This will provide you with the project management skills needed to succeed in the fast-paced world of investment banking.

2. Gain Experience in Financial Services: Work in roles that give you exposure to financial projects, whether it’s in risk management, M&A, or financial analysis. The more experience you have, the better prepared you’ll be for a career in investment banking.

3. Stay Updated on AI and Digital Transformation: Keep abreast of the latest trends in AI and digital transformation. Understanding these technologies will make you more valuable to potential employers.

4. Network in Financial Hubs: Networking is key to landing a job in investment banking. Attend industry events, join professional organizations, and connect with professionals in financial hubs like New York.

5. Master the Application of MBA Concepts: Focus on developing and demonstrating your ability to apply MBA concepts in real-world scenarios. Whether it’s through internships, case studies, or project work, showcasing how you can turn theory into practice will make you a standout candidate.

6. Leverage New York Experience for Global Opportunities: New York is not only a financial hub in its own right but also a launching pad for global opportunities. By gaining experience in New York, coupled with a PMP certification and mastery of MBA concepts, you can position yourself for roles in rapidly growing economies.

Growing Economies with Exciting Opportunities

As the global economic landscape evolves, certain countries are emerging as key players, presenting exciting opportunities for investment bankers. Let’s explore why countries like India, Saudi Arabia, Indonesia, Brazil, Guyana, Mauritania, the United Arab Emirates, Kenya, South Africa, and Morocco are becoming hotspots for financial professionals.

1. India: India’s economy is one of the fastest-growing in the world, driven by a burgeoning middle class, technological advancements, and a robust startup ecosystem. The government’s push for financial inclusion and digital transformation has created numerous opportunities in investment banking, particularly in sectors like fintech, infrastructure, and renewable energy. Experienced professionals with a deep understanding of project management and strategic finance are in high demand to help navigate this dynamic market. We are now offering courses in Hindi and Bengali!

2. Saudi Arabia: Saudi Arabia is undergoing a significant transformation under its Vision 2030 initiative, which aims to diversify the economy away from oil dependency. This includes massive investments in sectors like tourism, entertainment, and technology. The country’s strategic location and ambitious development plans make it a lucrative destination for investment bankers who can bring expertise in project management and digital finance.

3. Indonesia: Indonesia, the largest economy in Southeast Asia, is experiencing rapid economic growth driven by a young population, increasing urbanization, and expanding digital economy. The country’s push towards infrastructure development and its rich natural resources provide a fertile ground for investment opportunities, particularly in energy, mining, and technology sectors. Professionals with experience in managing large-scale projects and navigating emerging markets will find Indonesia a rewarding destination.

4. Brazil: As the largest economy in Latin America, Brazil is a key player in the global market, with vast natural resources and a diverse industrial base. The country’s focus on renewable energy, technology, and infrastructure presents significant opportunities for investment banking professionals. The ongoing digital transformation and economic reforms are opening up new avenues for financial services, making Brazil an attractive market for those with a background in project management and digital finance.

5. Guyana: Guyana is quickly becoming a hotspot for investment due to its recent discovery of vast oil reserves. The country’s economy is expected to grow exponentially in the coming years, with significant investments in oil and gas, infrastructure, and services. Investment bankers with expertise in managing large-scale energy projects and navigating emerging markets will find ample opportunities in Guyana.

6. Mauritania: Mauritania, located in West Africa, is rich in natural resources such as iron ore, gold, and offshore oil reserves. The country’s strategic location and investment in infrastructure make it an emerging market for investment banking professionals. Those with experience in project management and resource-based economies will find Mauritania an exciting frontier for growth.

7. United Arab Emirates (UAE): The UAE continues to be a global financial hub, with Dubai and Abu Dhabi at the forefront of innovation and economic diversification. The country’s focus on technology, renewable energy, and financial services presents numerous opportunities for investment banking professionals. The UAE’s strategic location, coupled with its advanced infrastructure, makes it a prime destination for those looking to expand their careers in the Middle East.

8. Kenya: Kenya is a leading economy in East Africa, known for its vibrant technology sector, often referred to as the “Silicon Savannah.” The country’s focus on innovation, infrastructure development, and financial inclusion makes it an attractive market for investment bankers. Professionals with experience in managing digital transformation projects and financial services will find Kenya a promising destination for career growth.

9. South Africa: As the most industrialized economy in Africa, South Africa plays a crucial role in the continent’s financial landscape. The country’s diverse economy, which includes mining, manufacturing, and services, presents numerous opportunities for investment banking professionals. The ongoing digital transformation and focus on infrastructure development make South Africa an exciting market for those with expertise in project management and strategic finance.

10. Morocco: Morocco is emerging as a key player in North Africa, with a focus on renewable energy, infrastructure, and tourism. The country’s strategic location as a gateway to both Europe and Africa makes it an attractive destination for investment. Professionals with experience in managing large-scale projects and navigating complex regulatory environments will find Morocco a promising market for growth.

Master of Project Academy’s Instructor-led PMP Course: A Gateway to Investment Banking Mastery

Enrolling in Master of Project Academy’s Instructor-led PMP Course is an excellent step for anyone looking to carve out a successful career in investment banking. This course offers more than just project management fundamentals—it provides hands-on, real-world insights into managing complex projects with precision and effectiveness, skills that are crucial in the high-stakes world of investment banking.

By learning from experienced instructors who bring industry knowledge to the table, you gain practical strategies and techniques that are directly applicable to investment banking projects, from managing M&A deals to navigating regulatory changes. This course not only prepares you for the PMP certification but also positions you to handle the intricate demands of investment banking, setting you on a path to mastery in this competitive field.

Conclusion

A career in investment banking is both challenging and rewarding, and a PMP certification can be the catalyst that propels you to the top. As AI and digital transformation continue to shape the financial landscape, the demand for skilled project managers will only increase. By obtaining your PMP certification, mastering the application of MBA concepts, and gaining experience in financial hubs like New York, you’ll position yourself for success in one of the most competitive fields in the world. Moreover, leveraging this expertise in rapidly growing economies like India, Saudi Arabia, Indonesia, Brazil, Guyana, Mauritania, the United Arab Emirates, Kenya, South Africa, and Morocco can open doors to exciting and lucrative opportunities, making you a valuable asset on the global stage. Whether you’re aiming to work in New York or another financial hub, the opportunities are vast, and the future is bright.

By emphasizing the evolving role of technology, the importance of project management in investment banking, and the exciting opportunities in growing global economies, this blog post provides valuable insights for professionals looking to advance their careers. The inclusion of how firms value the application of MBA concepts over the degree itself, along with the bonus section on the growth of financial roles due to AI and digital transformation, makes this a comprehensive guide for aspiring investment bankers.