The Service Strategy stage of the ITIL lifecycle for services is the stage where IT strategies are aligned with business strategies. Risks are determined, ITIL demand management processes are performed, the service portfolio is reviewed and finally ITIL financial management processes are followed. The ITIL Service Strategy and all the other stages of the ITIL service lifecycle are discussed in ITIL foundation training. ITIL financial management is an important part of the ITIL Service Strategy stage. This ITIL process determines whether the strategic objectives in terms of new or optimized services are financially feasible and whether it makes sense for the organization to invest in these new or optimized services. This is discussed in detail in ITIL Foundation training online.

The main objectives

It enables the business and IT to quantify the value of IT Services

For instance, let’s imagine that a telecom operator wants to introduce a new service for its subscribers. This new service will provide live football match scores to the subscribers. The ITIL financial management process makes the analysis of how much money will be generated from this service by the use of the subscribers. Also, how much money needs to be invested for introducing this new service. If the analysis output does not draw a reasonably profitable output, there is no need to publish this service.

It enables the possibility to quantify the values of individual assets that are necessary to perform services

Consider our example. If providing football match scores to the subscribers of an operator is a profitable business, and if the operator decides to publish this service, required resources and capabilities to produce this service need to be developed. For instance, new servers, new applications, new server administrators need to be acquired. The financial aspect of quantifying the values of these individual assets is in the scope of this process.

It enables the business and IT to analyze possibilities of operational outlooks and forecasts

As we described, before making an investment for a new service or infrastructure in a service provider organization, possibilities of operational outlooks and forecasts must be analyzed. The IT service manager must ask questions such as:

- How many servers need to support this new service?

- How many engineers need to support the system?

- What is the extent of the maintenance cost?

These kinds of estimations and forecasts are done under the scope of ITIL financial management process.

ITIL financial management in cooperation with other business units

This process cooperates with several business units when doing a financial analysis of services, investments and operational outlooks and forecasts. These business units are:

- Operation and support

- Project management organization

- Application development.

In order to do a financial analysis about an investment in a service provider organization, its operational and support cost needs to be determined. Will this new service require 24 hours support or only working hours support? Will it require weekend support? How many support staff needs to give support? These are evaluated with the operation and support business unit.

If a new service will be introduced and if this requires a new project to be initiated, then the project management organization is included in the process. The project management business unit determines scope, schedule, quality and cost of a project. Therefore, it is closely related to ITIL financial management process.

The application development business unit cooperates with the ITIL financial management process to determine application requirements in terms of which resources, tools or equipment are needed to develop the required services. Based on the requirements and necessities of the application development business unit, the ITIL financial management process makes its forecasts and outlooks.

The required financial data is collected, processed and used by ITIL financial management. Based on the requirements of the service provider, an analysis of whether an investment should be done is performed with the help of ITIL financial management process. The financial outcomes of running services, whether they are profitable or not, is determined by the ITIL financial management process as well.

The role of ITIL financial management in the transitioning from service strategy to service design

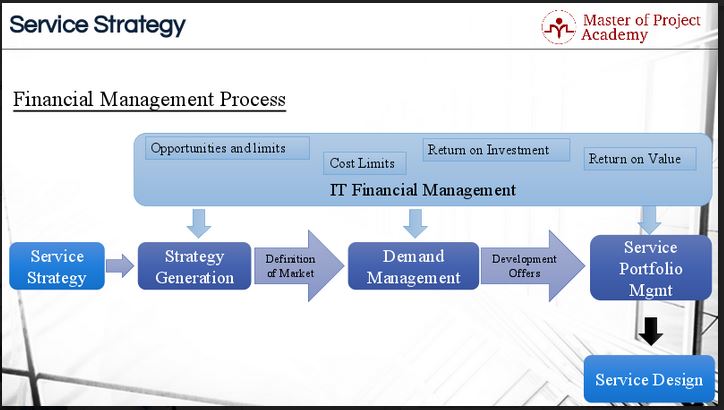

For instance, if a new service will not bring a profitable outcome, this is determined as the output of ITIL financial management process. Or, if an existing service is not profitable anymore and needs to be retired, these are decided based on the outcome of ITIL financial management process analysis. The diagram below shows the overall interaction of ITIL financial management when transitioning from ITIL service strategy to ITIL service design phase.

Service Strategy determines the IT strategies of an organization and strategies are generated during this stage to reach business objectives and vision of the organization. Then, a definition of the market is done to assess gaps in the market, which services can be the first entrant in the market, which are the most profitable areas etc. And these drive the demand management process asking questions such as:

- How many users will be using the services?

- What will be the amount of maximum concurrent users at a time?

These will determine the capacity options for the service provider. After the expected capacity requirements are determined the development offers are initiated. The team needs to decide what services will be planned, what tools and equipments are needed etc. and these new services or changes in existing services are managed in the service portfolio management process.

While handling all these stages, the ITIL Financial management process does opportunities and limits analysis. It determines cost models, does return on investment and return on value analysis to derive whether the investment will be profitable. It also aims to find the most cost-efficient options for the required tools, equipment and service development. And after these main stages, if it is decided that a service needs to be developed the next phase of the ITIL service lifecycle, ITIL service design, is initiated.

Without proper ITIL financial management, the ITIL service lifecycle cannot be successfully completed. Without a solid understanding of the financial impact of developing a new service or updating an existing service, the service can easily fail to produce revenue or value to the organization. This will mean that resources and capabilities were needlessly applied in the development of a service that is of no value to the business. These resources that could have been applied more effectively elsewhere. Proper ITIL financial management will always be a key step in developing an IT service.